This article and all of the sub articles regarding the 'Home Buyers Guide' are provided by Investopedia

Pre-Qualified vs. Pre-Approved

The Complete Home Buyer's Guide to Success

Pre-Qualified vs. Pre-Approved: What’s the Difference?

Both are good, but one has more heft than the other

Pre-qualified vs. Pre-approved: An Overview

You've probably heard that you should pre-qualify or be pre-approved for a mortgage if you're looking to buy property. These are two key steps in the mortgage application process. Some people use the terms interchangeably, but there are important differences that every home buyer should understand.

Pre-qualifying is just the first step. It gives you an idea of how large a loan you'll likely qualify for. Pre-approval is the second step, a conditional commitment to actually grant you the mortgage.

"The pre-qualification process is based on consumer-submitted data," says Todd Kaderabek, a residential broker associate with Beverly-Hanks Realtors in downtown Asheville, N.C. "Pre-approval is verified consumer data—for example, a credit check."

Here are the details on the differences:

KEY TAKEAWAYS

- Pre-qualification is based on data you submit to a lender, which will provide a ballpark estimate of how much you can borrow.

- Your pre-qualified amount isn’t a sure thing, because it's based only on the information you’ve provided.

- The lender won't take a close look at your financial situation and history to determine how much mortgage you can reasonably afford until you reach the pre-approval stage.

- You'll receive a conditional commitment in writing for an exact loan amount after you’ve been pre-approved.

Pre-Qualified

Getting pre-qualified involves supplying a bank or lender with your overall financial picture, including your debt, income, and assets. The lender reviews everything and gives you an estimate of how much you can expect to borrow. Pre-qualification can be done over the phone or online, and there's usually no cost involved. It's quick, usually taking just one to three days to get a pre-qualification letter. Keep in mind that loan pre-qualification does not include an analysis of your credit report or an in-depth look at your ability to purchase a home. It's based solely on the information you hand over to the lender, so it doesn’t mean much at all if you don’t provide accurate data.

The initial pre-qualification step allows you to discuss with your lender any goals or needs you might have regarding your mortgage. Your lender can explain your various mortgage options and recommend the type that might be best suited to your situation.

Your pre-qualified amount isn’t a sure thing, because it’s based only on the information you’ve provided. It’s just the amount for which you might expect to be approved. A pre-qualified buyer doesn’t carry the same weight as a pre-approved buyer, who has been more thoroughly investigated.

Pre-qualifying can nonetheless be helpful when it comes time to make an offer. "A pre-qualification letter is all but required with an offer in our market," says Kaderabek. "Sellers are savvy and don't want to enter into a contract with a buyer who can't perform on the contract. It's one of the first questions we ask of a potential buyer: Have you met with a lender and determined your pre-qualification status? If not, we advise options for lenders. If so, we request and keep on file a copy of the pre-qualification letter."

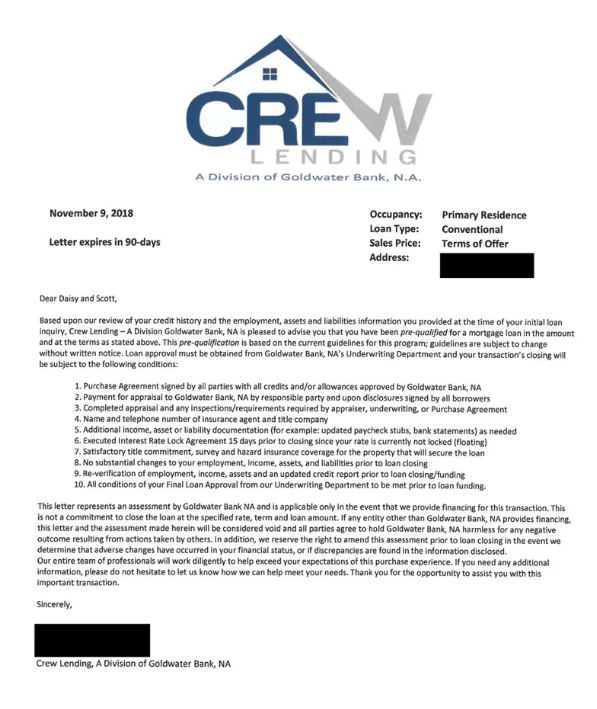

Here’s an example of what a pre-qualification letter looks like:

Pre-approved

Getting pre-approved is the next step, and it's much more involved. "A pre-qualification is a good indication of creditworthiness and the ability to borrow, but a pre-approval is the definitive word," says Kaderabek.

You must complete an official mortgage application to be pre-approved, and you must supply the lender with all the necessary documentation to perform an extensive check on your financial background and current credit rating. The lender can pre-approve you for a mortgage up to a specified amount after reviewing your finances. You’ll also have a better idea of the interest rate you’ll be charged on the loan at this point, because this is often based in part on your credit score, and you might even be able to lock in an interest rate. Some lenders charge an application fee for pre-approval, which can amount to several hundred dollars.

You'll receive a conditional commitment in writing for an exact loan amount, allowing you to look for a home at or below that price level. This obviously puts you at an advantage when you’re dealing with a seller, because you’re one step closer to getting an actual mortgage.

IMPORTANT: Being preapproved for a mortgage helps you to understand how much you can afford to pay for a home.

Pre-Qualified vs. Pre-approved Example

Here’s a quick rundown of how pre-qualification and pre-approval differ:

| Pre-QUALIFICATION | Pre-APPROVAL | |

|---|---|---|

| Do I need to fill out a mortgage application? | No | Yes |

| Do I have to pay an application fee? | No | Maybe |

| Does it require a credit history check? | No | Yes |

| Is it based on a review of my finances? | No | Yes |

| Does it require an estimate of my down payment amount | No | Yes |

| Will the lender give me an estimate for a loan amount? | Yes | No |

| Will the lender give me a specific loan amount? | No | Yes |

| Will the lender give me interest rate information? | No | Yes |

Special Considerations

The other advantage of completing both steps—pre-qualification and pre-approval—before you start to look for a home is that you’ll have a good idea in advance of how much you can afford. You won't waste time looking at properties that are beyond your means. Getting pre-approved for a mortgage also enables you to move quickly when you find the perfect place, and it lets the seller know that your offer is serious in a competitive market.

You’ll give your lender a copy of your purchase agreement and any other documentation necessary as part of the full underwriting process after you’ve chosen a home and made an offer. Your lender will hire a third-party certified or licensed contractor to do a home appraisal to make sure the house you want to buy is worth the amount you’re going to borrow.

The final step in the process is a loan commitment, which is only issued by a bank when it has approved you as the borrower, as well as the home in question—meaning that the property is appraised at or above the sales price. The bank might also require more information if the appraiser brings up anything that should be investigated, such as structural problems or a faulty HVAC system. Your income and credit profile will be checked once again to ensure that nothing has changed since the initial approval, so this isn’t the time to go out and finance a large furniture purchase.

Keep in mind that you don't have to shop at the top of your price range. Depending on the market, you might be able to get into a perfect home for less money than you’re approved for, leaving you with extra cash each month to set aside for retirement, the kids’ college funds, or checking something off your bucket list.

The best Stuart Realtor or Jupiter Realtor for Palm Beach County Real Estate or Martin County Real Estate - let Florida Home Sales work for you.

ABOUT FLORIDA HOME SALES

A experienced Stuart REALTOR, I cover all of St. Lucie County Real Estate, Martin County Real Estate and Palm Beach County Real Estate areas to help anyone sell their properties FAST or to help them find the new home of their dreams. When searching for a licensed Stuart Realtor who's going to work tirelessly for you and your family, look no further.

Designed & Hosted by IWANTAWEBSITE.com

LOCATION

3591 NW Federal Hwy, Jensen Beach, FL 34957

Licensed REALTOR

SL-3491448